|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Mortgage Broker Companies: A Comprehensive OverviewChoosing the right mortgage broker can make a significant difference in securing the best terms for your home loan. Here, we explore some of the top mortgage broker companies and what sets them apart. Why Use a Mortgage Broker?A mortgage broker acts as an intermediary between you and potential lenders. They help navigate the complex landscape of loan options to find the best fit for your financial situation. This can save time, effort, and potentially money. Benefits of Using a Broker

Top Mortgage Broker CompaniesHere are some of the leading mortgage broker companies renowned for their service quality and customer satisfaction. 1. Quicken LoansQuicken Loans is known for its robust online platform and customer service. Their streamlined process makes it easy for customers to manage their loans. 2. LoanDepotLoanDepot offers a wide range of loan products and has a strong reputation for customer satisfaction. Their online tools provide convenience and flexibility. 3. Rocket MortgagePart of Quicken Loans, Rocket Mortgage offers a fully digital experience with fast approvals, making it a popular choice for tech-savvy borrowers. What to Consider When Choosing a BrokerChoosing a mortgage broker requires careful consideration of several factors:

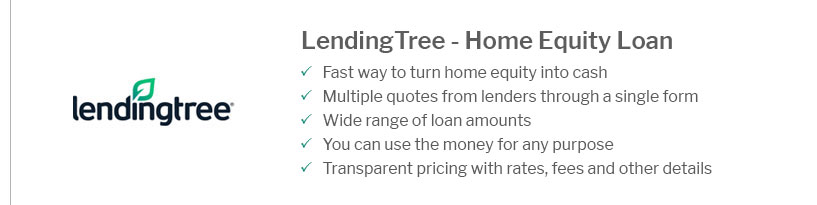

For those considering leveraging their home's equity, exploring options like an instant approval home equity loan could be beneficial. FAQs

Exploring top home equity loans can also be a viable option for those looking to maximize their property's value. https://www.reddit.com/r/loanoriginators/comments/11o9jer/how_to_find_a_good_mortgage_broker/

As a loan officer myself, I would say working with a mortgage broker is your best option. Your best best is to ask for referrals or even search ... https://www.kredium.com/blog/top-mortgage-brokerage-companies-in-the-us

C2 Financial Corporation was ranked as the top mortgage broker in America by AIME in 2019, 2020, and 2021. They closed on 8,416 loans with a total volume of ... https://wallethub.com/mortgage-lenders/san-jose-ca

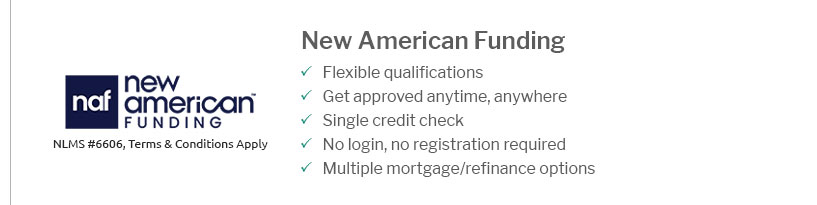

Best Mortgage Lenders in San Jose, CA - HomeStreet Bank - LeaderOne Financial Corporation - General Mortgage Capital - Luminate Home Loans - New American ...

|

|---|